I’ve always been about helping people create win-win solutions, just one Mom n’ Pop to another, but sometimes ALL the financial reward, and NONE of the financial risk, falls on one side of the transaction. I prefer to find ways that balance risk and reward equitably so that both buyer and seller are honored, respected and protected.

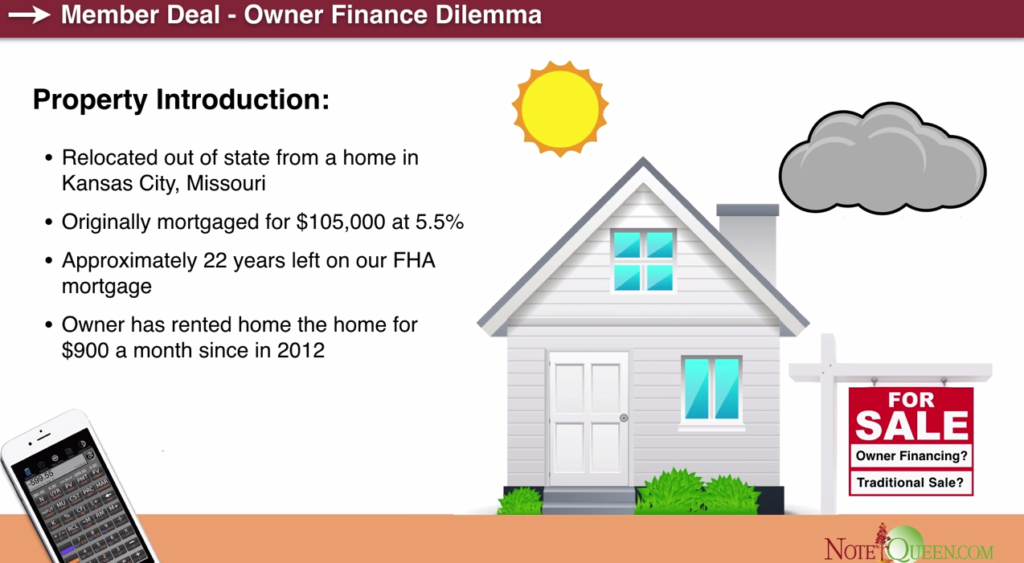

I had a gal call me wondering if they should do an owner carry deal with their existing tenant. They desperately wanted out from under the financial burden of the loan, taxes, insurance and unexpected maintenance bills, but they didn’t want to end up with an even bigger problem down the road.

You can watch the video discussing this in detail here. Should she do a short sale or sell to her tenant on terms? Or??

If the tenant had a reasonable down and/or the ability to pay a nice, juicy monthly payment, then I would be pretty excited about what they could do together. It would be a fair combination of risk and reward.

But in this case, the tenant buyer has no money to put down, and wants to pay only $600/month in rent… down from the $900 he had been paying… so it would be easier to take care of repairs as they arose.

This person is a church acquaintance, and while it’s nice to be able to do things for people in your community, a financial arrangement should still be stacked fairly. I’ve noticed that there can tend to be some abuse between members of religious organizations… people feel guilty evicting or foreclosing on members of their organizations, and the tenants or borrowers can use that to stack the cards in their favor.

Be sure to join us for our next mastermind call by entering your email below and/or downloading our app. Our podcast can be found here: Virtual Coffee: Anything Owner Financing & Notes.