Purchase at Half Price then Option Back is it Better Than Making a Loan?

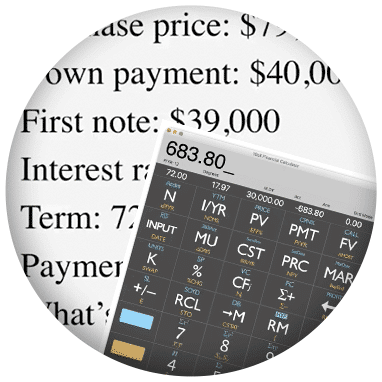

When you don’t feel comfortable making a loan, can you structure the deal a different way? One of the topics we covered in Property & Paper Live this week was someone who didn’t want to make a loan against land, so instead she bought it at 50% of the value, giving the seller (would-be-borrower) an option to buy it back for the same price plus