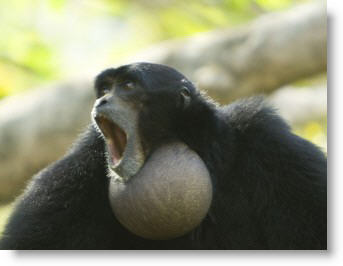

Trying to close a real estate transaction these days can be like trying to swallow an ice cube . . . it hurts a little, and if it gets stuck

What is “liquidity?” If an investment is “liquid,” then it’s easy to buy it and sell it and convert it to cash in a relatively short period of time. The real estate market has lost a lot of its liquidity due to the credit crisis and subsequent PTSD (Posttraumatic Subprime Disorder).

Many buyers who could buy, won’t, and the one’s that would buy, can’t. They can’t get the financing . . . it’s in the freezer. So what can we do to help thaw this insane institutional ice cube that’s choking the real estate market?

- We can wait for a new administration to “fix” everything . . . (don’t hold your breath)

- We can hope the financial institutions can borrow enough money to pay for therapy so they can heal from PTSD and start lending again without psychotic funding conditions

- We can put deals together without any institutional financing at all (my personal favorite)

The way to liquefy the real estate market is to add a little heat, all by ourselves. There are so many ways to put transactions together without having to ask permission from some catatonic financial institution. Sellers can sell, buyers can buy, real estate professionals can eat, and prices don’t have to fall through the floor.

But we need some flexibility to create liquidity. The seller needs to be willing and able to offer terms, provide the financing, carry paper. “Like who?” you ask. Like:

- People who own their properties free and clear

- People who insist on getting their price (even though it’s somewhat unrealistic)

- People who have a large equity position in their property (a small loan)

- People who have a medium-sized loan on their property

- People who owe as much as their property is worth but have great underlying financing (a loan that has favorable rate and terms)

- People who owe more than their property is worth . . . HUH??? (Surely this was a typo . . . NOT!)

Yes, even people who could never refinance or sell their property for what they owe, can sometimes get out from under the payments without a short sale or foreclosure or a ding to their credit (as long as they’re not behind in payments yet).

Don’t you think there might be a buyer out there (who doesn’t have a big down payment or good credit) that would gladly pay $50,000 more than a house would appraise for just to have a chance at home ownership? You bet.

The “Illinois type” title-holding land trust in conjunction with the NARS Equity Holding Trust Transfer System allows almost any type of seller carry back strategy to work without triggering the “due on sale” clause. The buyer can just take over the existing financing in either a “subject to” or “wrap-around mortgage” fashion.

- Read more about the Land Trust

- If you’re a seller wondering if you qualify for seller financing, email me

- To talk about buying a home without bank qualifying, call me!